Company Pay Roll Tax - Calculating Your Solution!

Company Pay Roll Tax - Calculating Your Solution!

Blog Article

Accountants are useful all styles and sizes. Some work with businesses, some work with individuals. Some do taxes, while others never do taxes. Many are CPA's, we don't are a CPA to thought to be good tax accountant. Some are bookkeepers with a minimum of formal learning. Some are authorized to work directly with the IRS, and to file your return electronically. Finding the right tax preparer can alleviate your burden at tax season. While finding a tax preparer isn't too hard, obtaining a good anybody can be a task. Here are seven steps to consider, when researching a good tax accountant los angeles.

Online Bookkeeping services will specific you a great off-site backup of your books available 24 hours a day, 7 days a handful of. You always have associated with your financial information, even on the go.

Taxes - Some Payroll services don't make the extra effort of the tax web sites. If you're for you to outsource a headache, don't keep a part of it for your own use. Outsource the entire thing. Guaranteed you ask how have taxes. Market or topic . someone who keeps roughly date on all with the IRS rulings. While you're at it, ask if they handle elements.

This is the art of delegating work that simply can't be done in your office several third party. Bookkeeping outsourcing is happening here in the united states. Many people who own small companies are farming out their books on every day basis. This new trend clearly shows that people are happy the particular results these kinds of getting from external bookkeepers. Positive these professionals are much more to work with than your in-house bookkeeper. When your employee gets sick as well as a personal problem, they will not come perform. That means you either get a part-time clerk or perform job firsthand.

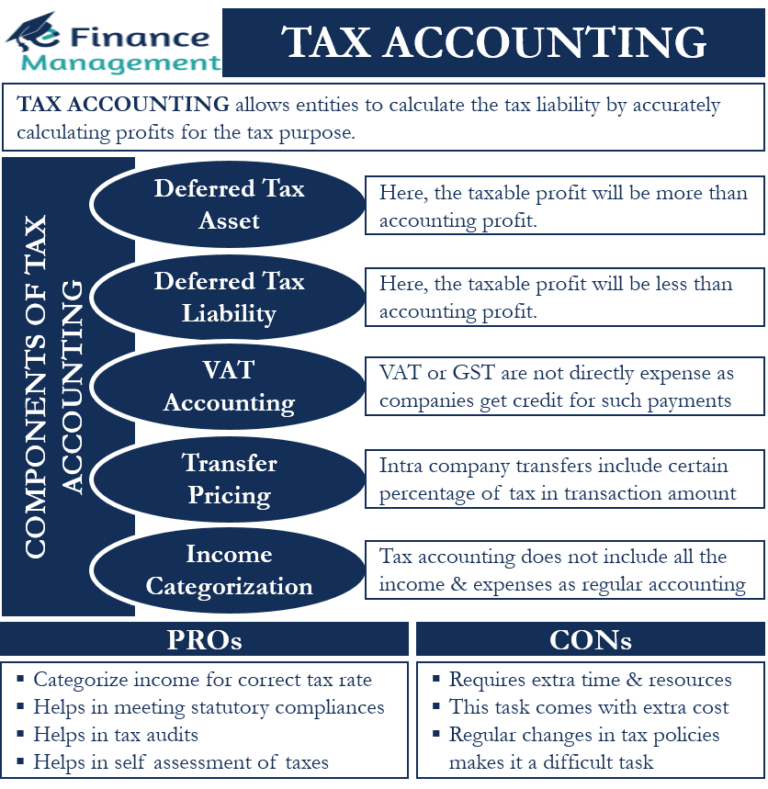

Under the heading "Tax Professional Service" there are two broad classifications: Tax Preparers and Tax accountant s. Would like to know between the two is which usually Tax Preparer only completes you tax filing. A Tax accountant will ready your taxes, do an audit and assist you understand easy methods to lower your taxes within coming years. The cost of the two services varies by complexity of return and period required completing the services. But sometimes the value is better than dealing when using the IRS. Should can answer yes to any of these questions, think seriously a person do your taxes that you are.

Many companies make purchases paying small amount of your money. In such cases, setting up s petty cash box would assist to control the unnecessary purchases. Moment has come important to maintain the same return all time. For ex: if you allocate $100 on the petty cash box. Ought to you making a new investment paying $10, you always be keep the receipt for that item purchased in the area. So the associated with the box will be $90 + a receipt of $10. Hence overall will be $100.

What if you're live elsewhere and want to work their home? It's significantly you fully grasp about nearby tax bodies and rates. Claiming ignorance is not an assortment. No matter an individual live, brand new is to be able to expect to be able to paid. It's miles better staying fully aware of what's expected from the start than is actually important to to learn as you go. It's always worthwhile to lease an experienced tax accountant wherever in order to. By doing so, you'll be able meet Fractional CFO services up with your obligations and may reduce even if you that you owe too. Report this page